Banks have expressed wariness of the success of FinTechs in gathering deposits in recent years. These organizations appear to be growing faster than our industry, building share and “eyeballs”, and yet, none has shown meaningful profits. In fact, even many of those that have been acquitted by larger banks, such as Simple and BBVA, ended up sunsetting. Fintechs traditionally focused on a narrowly defined product line and consumer segment. That, coupled with their never-ending quest for significant headcount growth, have proven to significantly impact both customer retention and market valuation.

JP Morgan Chase has taken the opposite route to retail banking execution, and its strategy appears to have led to great success. Many of us consider their approach unapplicable to our banks due to the resource limitations we all face, especially relative to the biggest bank in the world. I posit we can certainly draw lessons learned from the Chase strategy and execute elements of it while staying true to our brand promise and within resource constraints.

Chase’s approach to retail banking is the exact opposite of the mono line, all-digital competitors. In fact, Chase focused on offering an extremely broad product line to its retail households, a smart move considering this is a major vulnerability of their Digital competitors. Chase offers over 35 banking and payments services that many consumers and small businesses consider essential, all available from all Chase distribution channels and outlets. This is an intentional and highly effective competitive move from Chase, and all banks can emulate that move (broadening their product line and channel choices) when it comes to competing with FinTech consumer offerings.

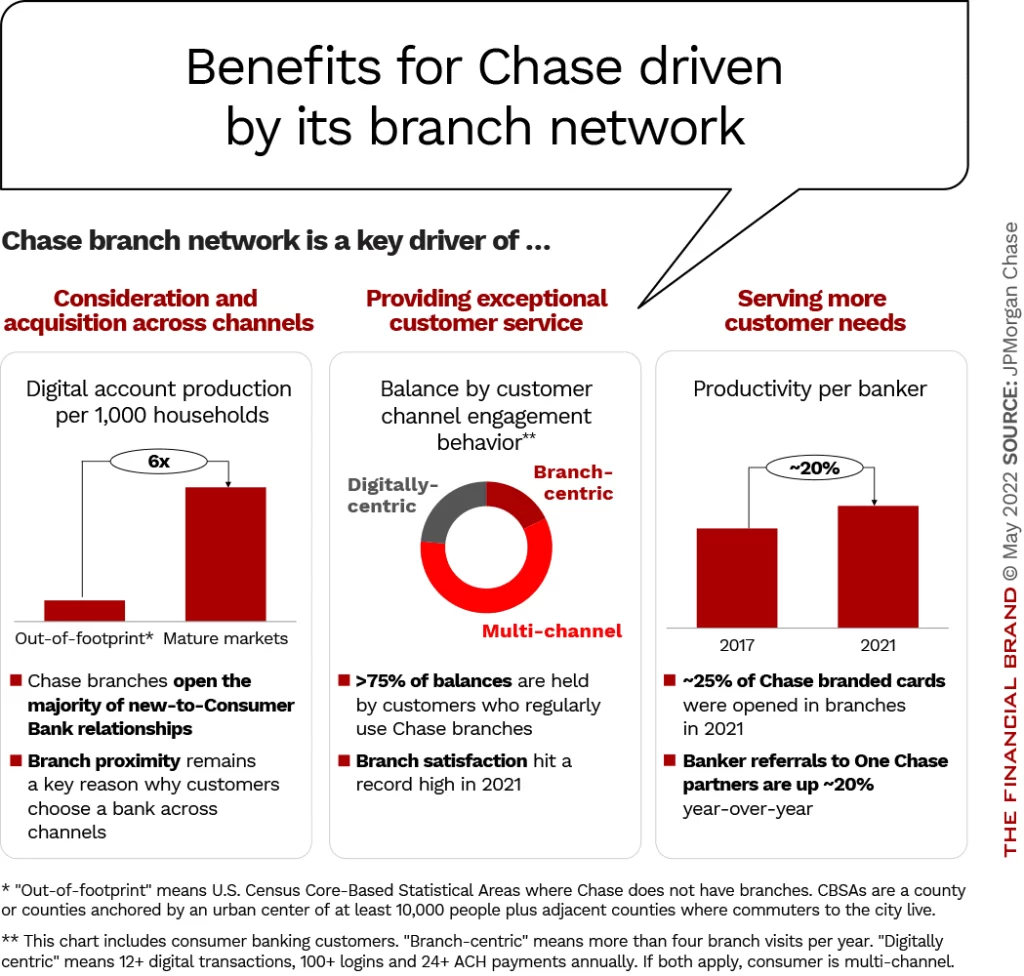

Chase’s long-term mobile-forward strategy has also been paying dividends. Mobile-active customer count has increased 35% since 2019. Over 50% of those customers use at least one financial tool offered by Chase. The surprise, though, is that 70% of the bank’s customers visited a branch in 2021 and 20% met with a banker to discuss their financial needs. These numbers persist across generations and age- groups.

Chase has always had a three-pronged strategy in the consumer and business banking space:

- digital technology and product development;

- distribution, which includes marketing, especially for credit cards;

- and expanding its branch network.

Chase’s philosophy is that, rather than being seen as substitutes for one another, digital and conventional banking channels should complement each other. While the role of each is evolving, but both remain necessary to its success. As we observe other forms of innovation, this approach resonates. When radio was invented, newspapers didn’t disappear. Well over a millennium post-innovation, print readership has declined markedly, but the tail is still strong and it has not disappeared. Similarly, when moving pictures were introduced, radio didn’t die. It simply morphed and continues to do so until today and beyond. Ditto for TV and streaming.

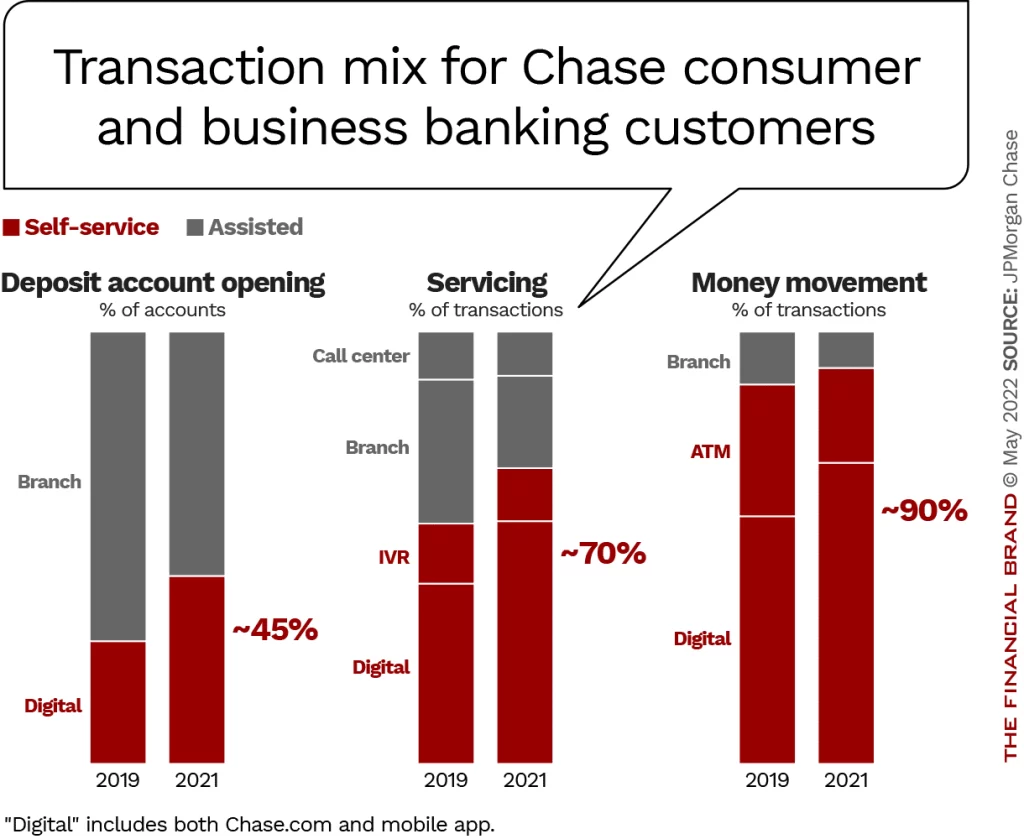

“Customers are using self-service channels for more of their day-to-day needs across account opening, servicing and money movement transactions,” said Chase’s co-head of consumer and business banking Marianne Lake. “We strengthened our model by investing in digital channels to provide more services and improve customer experiences.” Customer satisfaction scores prove the point, and also demonstrate that multi-channel usage leads to higher satisfaction across all channels, an important point for all of us to consider. Digital banking doesn’t replace the branch experiences for most customers. It simply enhances it.

Most customers who are new to Chase begin their relationships in a branch, according to the bank management. It takes BOTH branches and digital services to create a compelling, lasting customer relationship, where on-going innovation of both product and delivery are at play. Accordingly, Chase continues to introduce new products, such as a variation on buy now, pay later service based on a debit card, a mass-market wealth building service that will reside inside the Chase mobile app, and an app-centered Chase travel service that will include concierge assistance. Similarly, Chase augmented its business banking basic product offering to include Real Time Payment options for high-balanced small businesses.

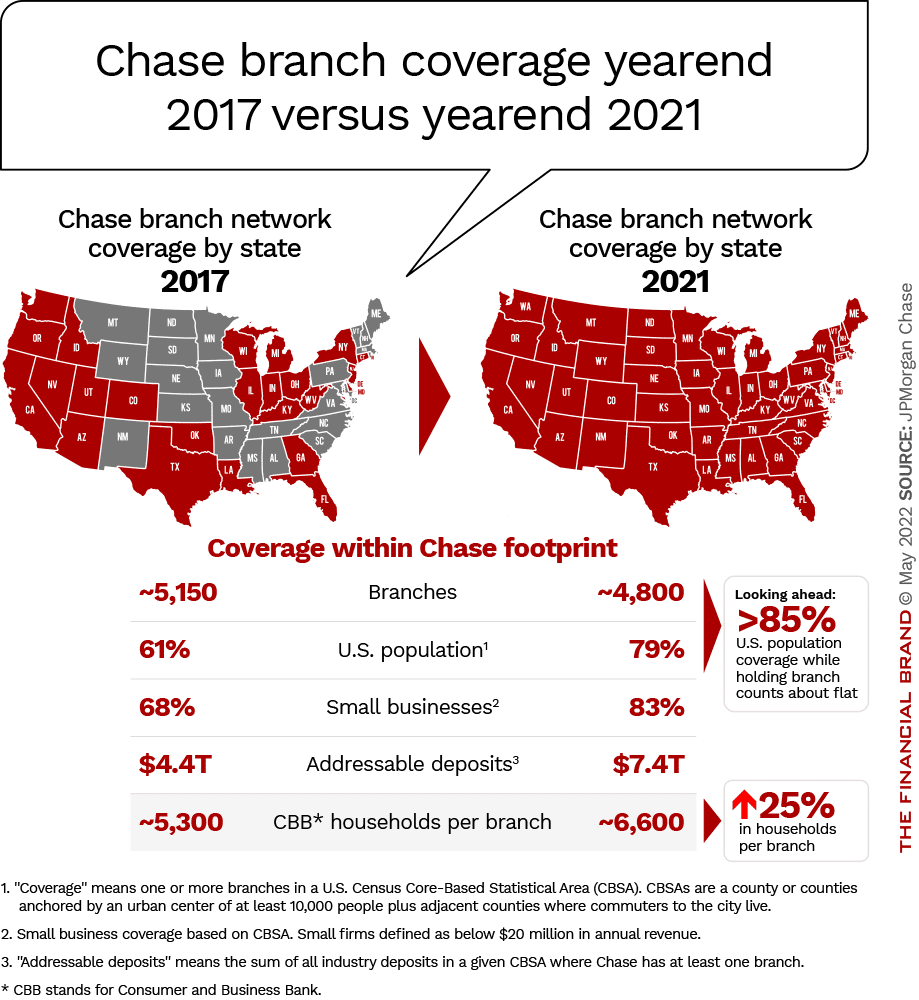

Interestingly, Chase has become the first bank to have branches in all of the lower 48 states. The bank carefully targets high density deposit markets, then strategically places a meaningful number of branches in that market with the intention of capturing greater-than-average share. The picture below tells the story.

Equally interestingly, while branch coverage increased, the absolute number of branches decreased. Approximately 500 new branches have been built since 2017, including about 300 in new markets. Examples of “high opportunity” markets, and the number of branches opened there so far include Boston (31), Philadelphia (44) and Washington, D.C. (41). At the same time, Chase shuttered 850 branches in mature markets during the period.

Chase’s new branches aren’t all alike, and many test new formats. For example, Chase’s “community centers” are designed for underserved urban communities. These branches are staffed them by unique specialists who cover areas such as in business mentorship, home lending advice, and community managers trained in outreach. The bank clearly considers branches key to growing the number of households it serves. Ominously for many of us, Millennials and Gen Z consumers account for 45% of the bank’s customer base.

Management strongly believes that the investment in the expanded branch system played a key role in the bank’s deposit growth. They further believe that a branch takes a decade to fully season. Using this criterion, more than 20% of its branches are not yet mature. And yet, the bank’s strategy for capturing share in high-deposit markets using physical; distribution has been proven to be successful. Management plans to continue executing on the strategy in the coming years.

Referral business and the building of broader relationships through the branch has been strong and is a big part of what Chase likes about branches when they move away from transaction roles. Nearly nine out of ten new investment customers come from internal referrals and 75% of new small business customers start as consumer customers of Chase. In addition, about half of consumer mortgage originations begin in the bank’s branches. This is a huge opportunity for community banks, which are better positioned to make referrals work, yet their numbers aren’t often as good as this megabank’s.

Despite Chase’s huge investment in both physical and digital channels, or perhaps because of it, branch operating costs continue to fall, albeit at a slow pace. The transaction mix depicted below explains the drop in operating expense. This gift will keep on giving for a long time to come.

Another example of an important digital move is Zelle. Chase customers’ use of Zelle for both consumer needs and business needs was up 30% in 2021 over 2019. These figures hold true for the banking industry in general, yet so many of us are still leaning toward Venmo (“because my kids use it”) and, justifiably, because of rampant fraud.

One more example of an approach which I have been recommending to our banks for some time now is a powerful combination of digital and in-person experiences. One element in the Chase mass-affluent strategy is one-on-one video and phone-based advice from J.P. Morgan Personal Advisors. A related element consists of digital tools and planning aids via Wealth Plan by J.P. Morgan. Both services will be accessed as part of the bank’s mobile app.

The primary lesson I continue to learn from Chase is its commitment to realizing a long-term vision, its patience and tenacity in executing it,. And it’s continued mid-course corrections as they learn, evolve and grow the business. This is a lesson as can all afford to learn, regardless to our size, and possibly even regardless to our investor base. If our story resonates, and execution is growing legs, they will be more patient with us than the next quarter.