Robert Albertson’s most recent piece brings him back to his roots – he is a bear at heart. I can see his point, though. Beyond the charts and numbers, public sentiment has turned even more negative than in the past year. In addition, public behavior – consumer and business alike – has changed markedly. Spending is down across the board, open jobs are down dramatically, and unemployment is up meaningfully as well. Major metro market real estate is suffering, and specific sectors, such as hospitality in Sam Francisco, are down sharply.

Elections will be upon us in three months. Much depends on its results, especially regarding the regulatory climate. All of you are already feeling the undeniable sting of regulatory tightening. Those who are not will inevitably join their larger brethren.

In sum, winter is coming… How severe and long it will be depends on the election results and the economic consequences of opposed policies. Based on this thorough analysis, Albertson is pessimistic. I see the same signs but hold conclusions for a few more months.

Full attribution to Robert Albertson, who until recently was Chief Strategist of Piper, Sandler Financial Services Group.

Outlook Into 2025

Economy Weakening … Recession Probability Rising Further

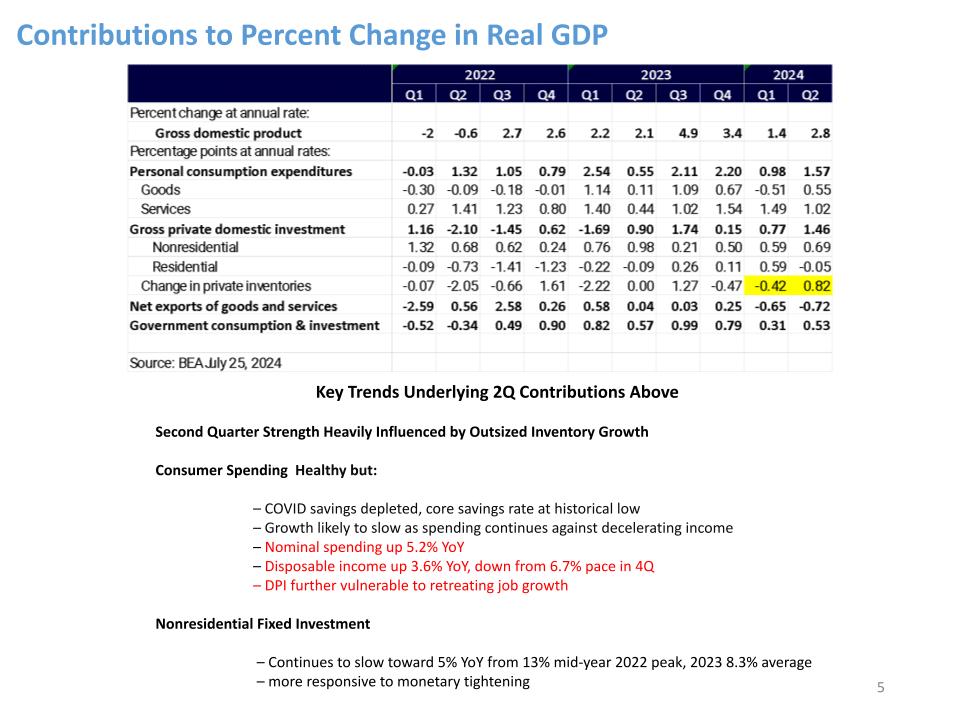

Second-quarter GDP strength was heavily influenced by outsized inventory growth

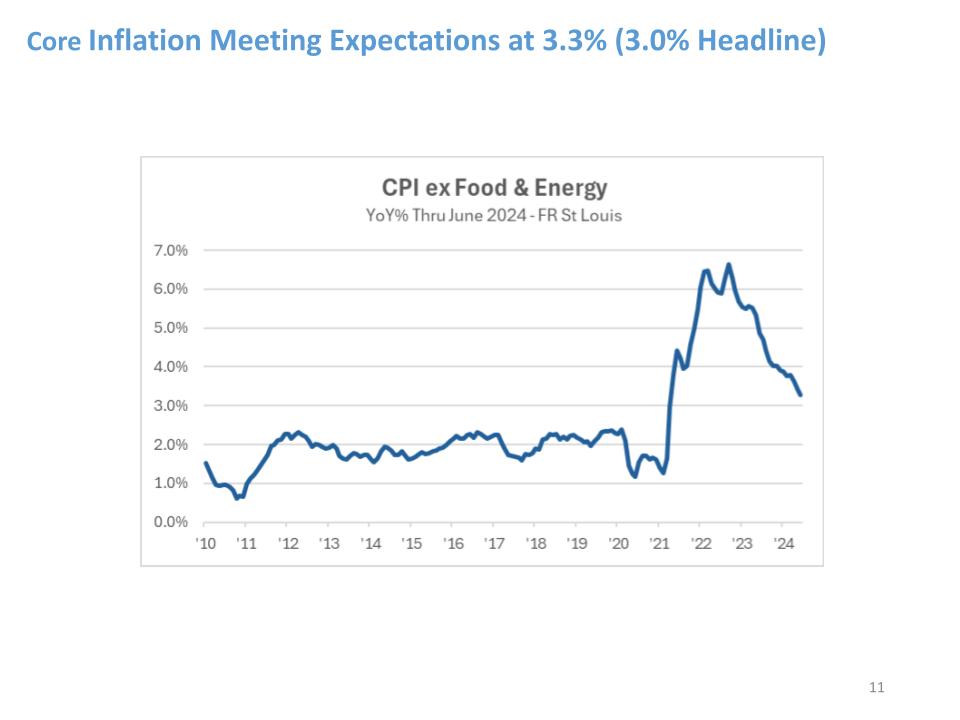

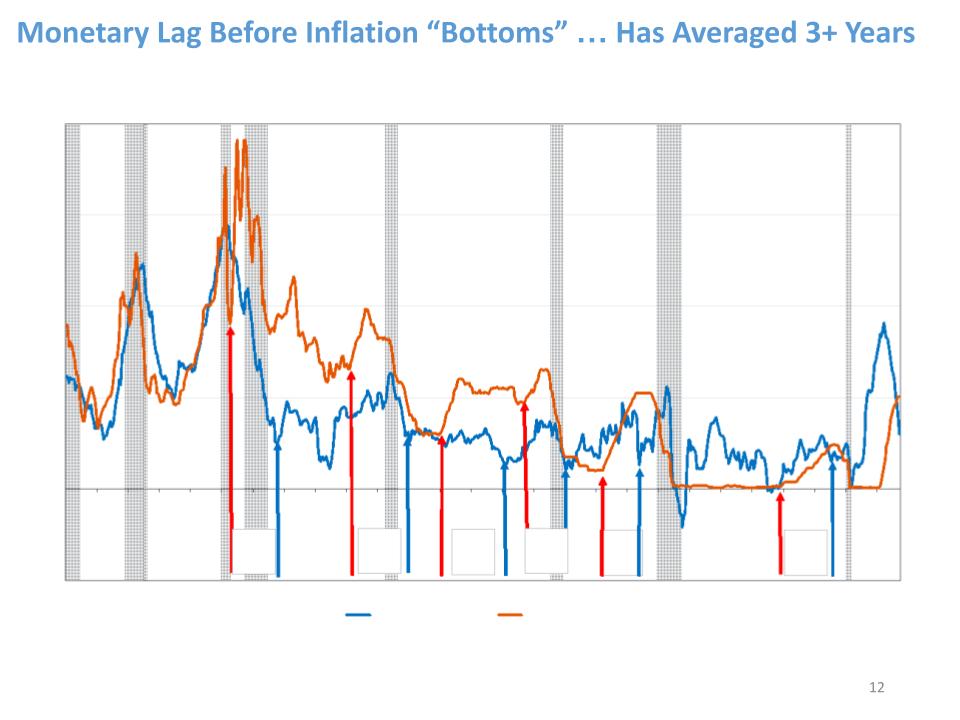

Monetary policy lag has been underestimated

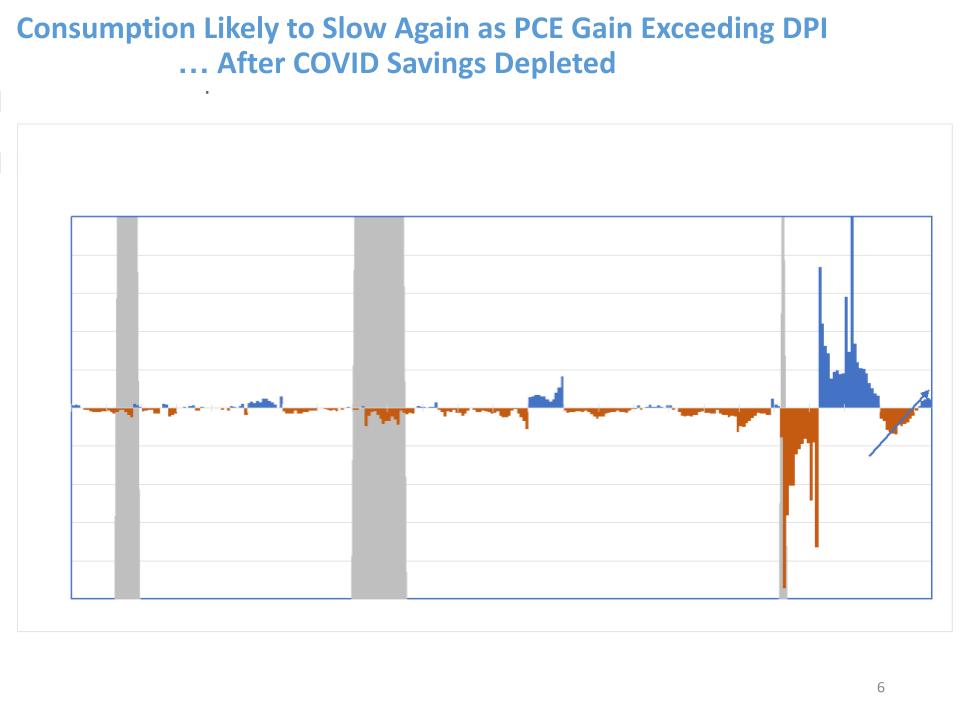

Consumer spending overdue for contraction

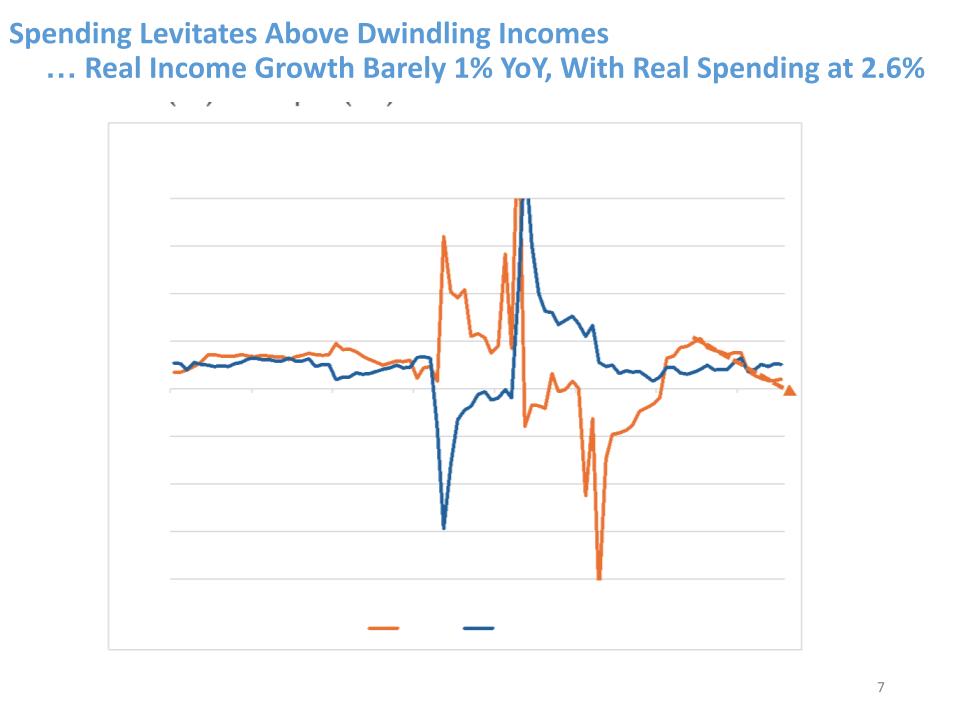

… Consumer spending pace levitating, again exceeding income growth

… Personal income growth decelerating, now barely at 1% in real terms

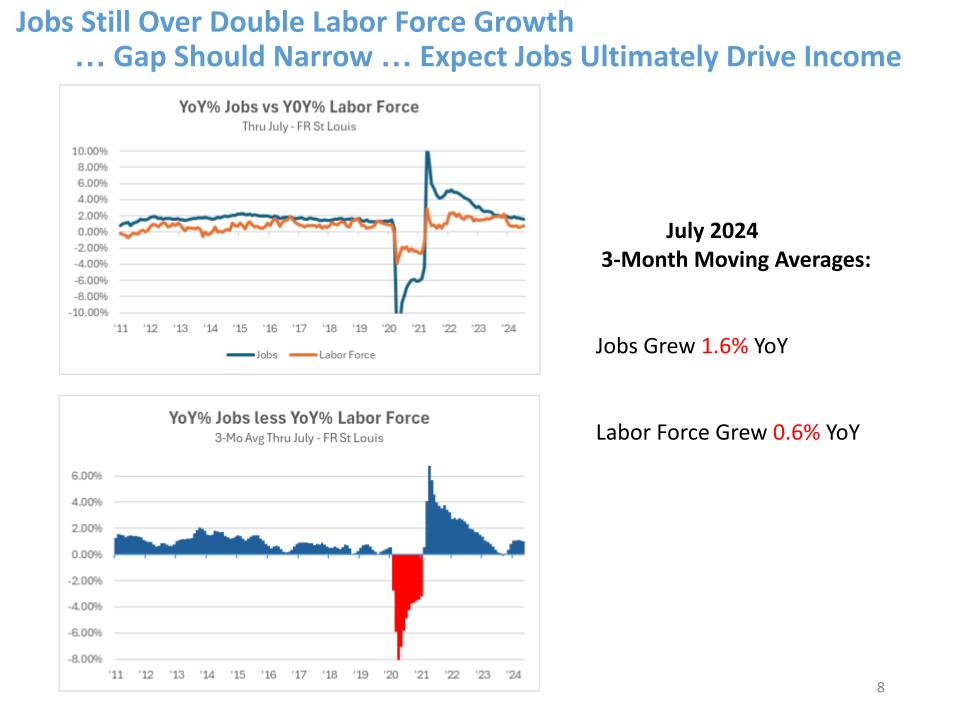

… Employment gains contracting, can drive incomes down further

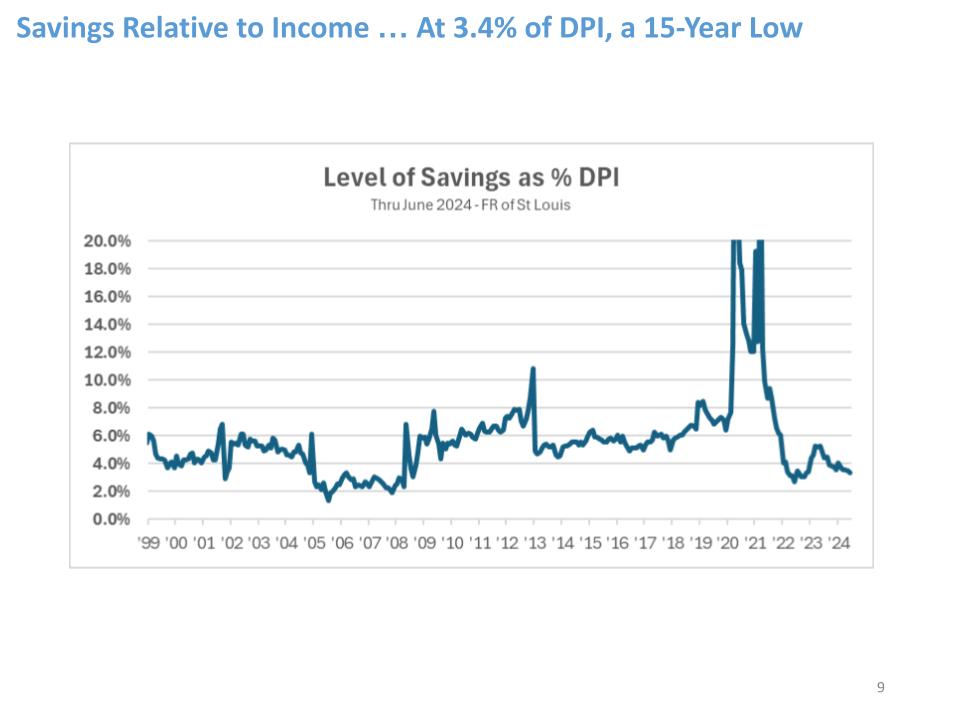

… COVID excess savings depleted, savings rate at 15-year low

Business spending continues to weaken

… Nonresidential fixed investment growth has dropped for seven consecutive quarters

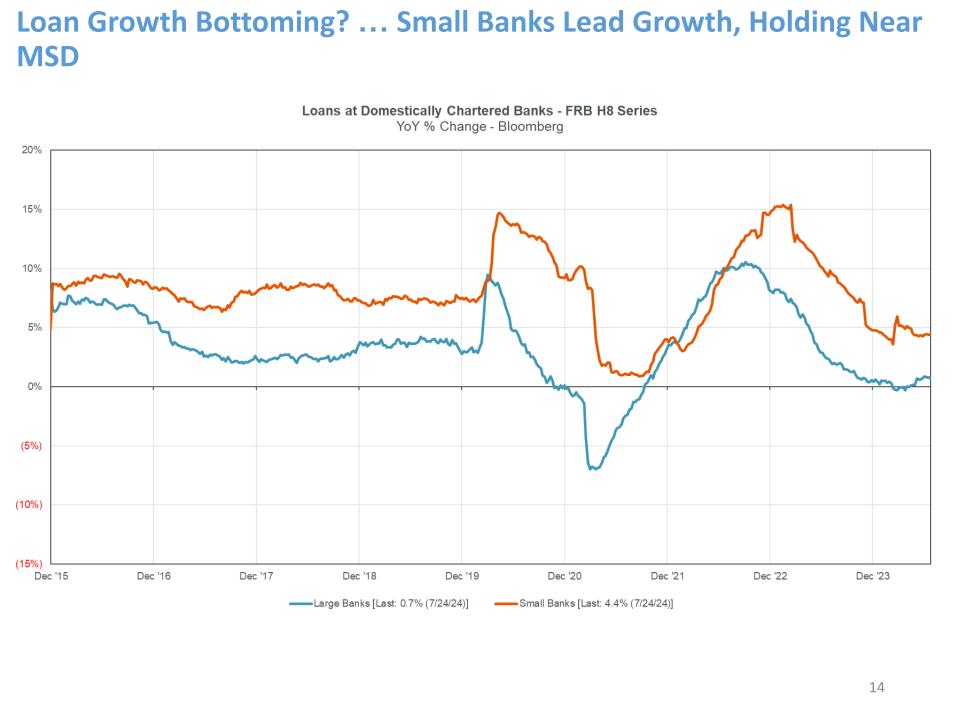

… Bank lending still moribund, tied to economic recovery hopes

Monetary Easing Now Certain

… Fed rate cuts finally begin in September

… Benefits from cuts for banks appear to be overestimated

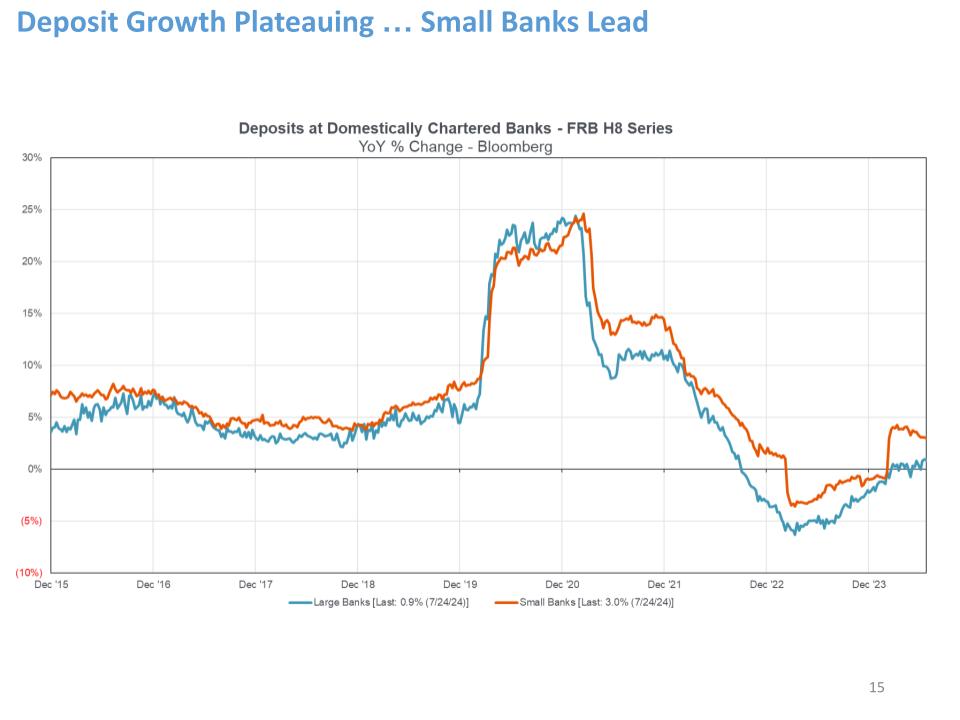

… While commercial deposit rates will decline quickly, consumer deposit rates likely to be sticky

… Commercial loan yields will also contract quickly,

… Fixed-rate asset repricing potential the larger positive

Geopolitical Uncertainties Unusually High

… War and threats in Ukraine and Mideast

… U.S election over-simplified choice appears to be either for inflationary spending or a trade war

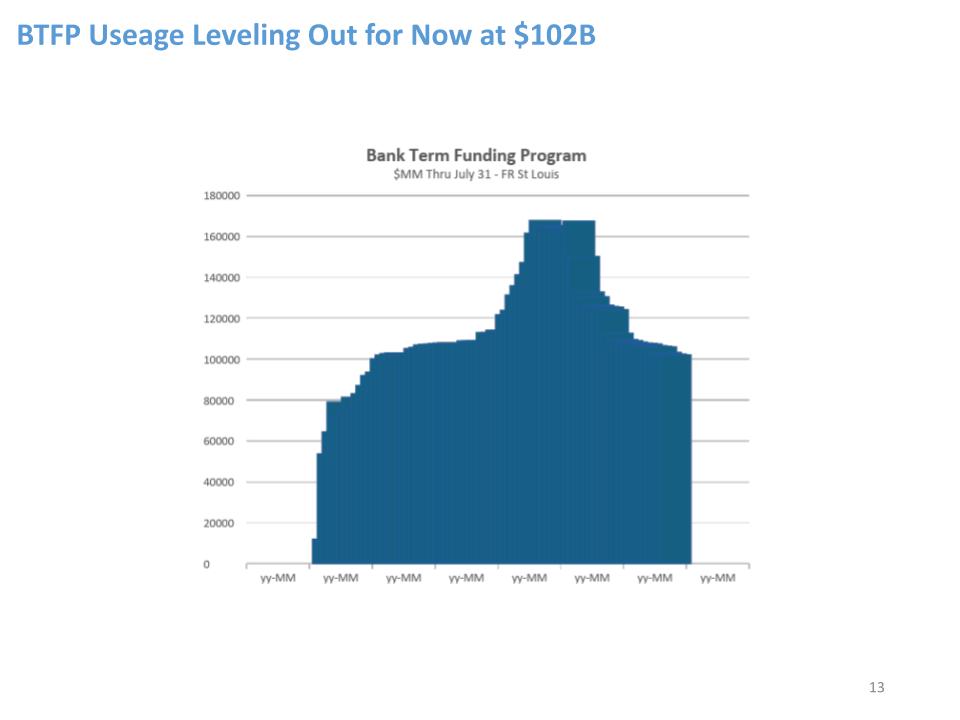

Bank funding still solid, although brokered deposits and borrowings need to fall further

… Debt capital raises still likely, pending Base III Endgame resolution

… Loan loss reserves deemed appropriate, but economic outlook could

… Regulatory environment still unhospitable to consolidation

Recent Bank Results & Outlook

Based on banks’ management guidance, the 2024 net interest income outlook has clearly fallen further and analyst questions continue to focus most on margin details, although net interest income increasingly appears to at least be bottoming now for most. Lean growth and pipelines appear to be the next most common area of scrutiny. Deposit trends would rank third and credit issues would be fourth. From my perspective bank earnings growth will be more influenced by the economic cycle than Fed rate cuts. Investors seem to be enamored with and reliant on the latter.

Balance sheets are largely stalled, essentially flat with the prior quarter. Muted, slowing loan growth is prevailing with only customer credit cards the exception. Commercial demand is slack. However, utilization rates may be stabilizing with a few showing a minor uptick. Almost no banks are yet counting on any meaningful 2024 second-half loan demand revival and the 2025 outlook was not addressed. It is safe to say any revival will depend on the course of the broad economy and borrower confidence, which may weaken further.

Deposits were largely stable to up slightly. Noninterest-bearing deposits are showing signs of stabilizing. Deposit costs are also stabilizing. The deposit remixing cycle is seen slowing with some expecting a final end to this by the fourth quarter. Both FHLB borrowings and brokered deposits continue their meaningful decline for most. Several banks have begun to disclose “down-rate” beta assumptions, specifically disclosing the percentage of deposits that are considered highly market sensitive, with a beta range of 80-100%. Overall cumulative betas appear for most to be peaking in the high 30s% range, with interest bearing in the mid to high 50s%.

Net interest margin and income, with exceptions, continue to slide slowly for most, but all seem to be calling the bottom…many indicating it was this quarter, with a flattish third quarter expected and a bump in the fourth. A small handful have already shown modest gains.

Investor understanding over the net interest outback relative to rate cuts is fairly simplistic, however. Many are highlighting that commercial deposit betas will provide NIM benefits when rates do decline and, therefore, Fed rate cuts are considered the defining positive. While this benefit is real, this potential is more than offset for many by concurrent downside in variable-rate loan yields, consumer deposit rate sickness and the overall weakness is loan demand. Most banks were assuming a September and a December Fed rate cut. The weak July jobs report suggests more aggressive cutting could take place.

However, the fundamental, driving positive variable for net interest income is fixed-rate asset repricing, which should be present well into next year, and is actually the result of higher interest rates, relative to the past. Most investors seem eager for eventual Fed rate cuts, but their absence could actually be a net positive for those with large, rate-sensitive commercial loan portfolios. Healthy rebound and growth in net interest revenues for 2025 is still unclear, primarily hostage to a revival in loan growth.

A few banks conducted significant securities repositioning exercises during the quarter, with some actually taking meaningful losses to revamp portfolio yields. I expect more such actions in the upcoming quarter. This is consistent with a view toward imminent rate cuts.

Fee income rebound for investment banking, capital markets and M&A, after five more moderate quarters, gave way after a strong first quarter recovery that was then bested for many in the second quarter. Deal flow and capital markets pipelines have re-filled and second half prospects look increasingly promising.

Credit dynamics were somewhat mixed. Notable deterioration in office-driven CRE nonperforming and additional reserve builds occurred, but only for a handful of banks. All managements are insisting reserves are adequate and nothing unexpected has yet occurred. General office reserves remain averaging 10% and higher, with a few making minor reserve additions. Overall, chargeoffs and nonperforming ratios were generally unremarkable and several actually revealed moderate improvement, particularly in declining criticized assets. Multifamily and office real estate were mostly exceptions.

The outlook for full year net chargeoffs, where expressed, is encouragingly still within a tight, up-slightly to down-slightly range. So no substantive credit risks have emerged at the moment and managements believe any notable future loan losses will be idiosyncratic in nature. One bank even projected a likely reserve release before yearend. Nonetheless this space still merits watching.

Despite the pending Basle III Endgame finalization, few investors seem concerned anymore. Yet a handful of banks have remained cautious on buybacks until final details emerge. AOCI questions have also largely ebbed, as CET1 ratios excluding AOCI continue to improve.